The Anatomy of a Scam: How False Promises, Slick Sales Funnels, and Endless "Investments" Drain Victims' Savings

Uncovering the Alleged Deceptive Practices Involving Blake Evertsen, Eyad Abbas, and Kevin Vieira's Amazon Done For You and Credit Expansion Scams

In 2024 and 2025, lawsuits filed in the state of Florida named several individuals, including Blake Evertsen, Eyad Abbas, and Kevin Vieira, for their involvement in Amazon automation and credit expansion ventures. Despite polished appearances — professional websites, signed contracts, and persuasive sales closers — the reality was devastating: victims lost thousands, sometimes hundreds of thousands, of dollars. These cases reveal not just isolated misconduct but a recurring pattern of calculated deception. Understanding that pattern is the first step toward avoiding it.

The Polished Sales Pitch

The fraud does not start with shady cold calls. It begins with professionalism: crisp pitch decks, branded presentations, and legally binding contracts delivered through services like DocuSign. Victims are promised "passive income" through automated Amazon stores, "easy dispute options" if anything goes wrong, and "guaranteed returns" within set periods. According to a lawsuit filed on February 19, 2025, by Randy Martono-Chai, defendants Blake Evertsen, Eyad Abbas, and Kevin Vieira presented an investor pitch and a professional "Amazon Automation" pitch deck containing false information, which Martono-Chai relied upon when investing approximately $200,000 in automation and credit services.

The Social Media Trap: How Ads and Closers Pull Victims Into the Scam

Professional-looking social media ads serve as the entry point. These ads, often created by third-party marketers, depict luxury lifestyles and highlight "exclusive" business opportunities. Interested individuals are routed to high-pressure closers whose only job is to finalize the sale. According to a lawsuit filed on November 18, 2024, Katy Ferguson alleges she was recruited through polished social media marketing into investing over $80,000 with promises of Amazon automation success. Behind the scenes, a commission structure ensures everyone involved profits — except the victim.

The Pattern Described in Victim Lawsuits

Professional Ad → Sales Closer → Credit Expansion → Cash Transfer → Store Failure → No Refunds → Victim Debt and Ruined Credit

The One-Two Punch: How Credit Expansion Sets Victims Up for Financial Ruin

One of the most devastating tactics is weaponizing the victim's own credit. Victims are helped to open large new credit lines — framed as "smart financial leverage." They are encouraged to immediately spend this newly available credit to fund Amazon stores, advertising campaigns, and "upgrades." In his lawsuit, Randy Martono-Chai describes being instructed to obtain significant credit lines, which later collapsed due to misuse and led to lasting financial harm. When the businesses fail and refund promises evaporate, victims are left holding massive debt, ruined credit scores, and no easy recourse. It is a one-two punch: helping victims borrow, then taking the borrowed money.

The Investment Mirage: Endless Opportunities to Take Your Money

For those who invest once, the scam rarely ends there. Victims, plaintiffs allege, are soon pitched additional "investment opportunities":

- Ad revenue programs

- Short-term small business loans

- Real estate flips

- Aged Amazon stores for "instant profits"

According to the lawsuits filed by Martono-Chai and Ferguson, both plaintiffs were encouraged to participate in additional investments beyond their original Amazon store agreements, each new opportunity framed as a way to "recover" or "accelerate" their initial investments. In reality, each was just another carefully crafted mechanism to extract more money, deepening the financial and emotional damage.

How the Lawsuits Describe Efforts to Avoid Accountability When Things Collapse

When the promised profits fail to appear and victims begin asking questions, the people involved in these lawsuits deploy stalling tactics. Communication becomes sparse. Refund requests are ignored. Contracts contain "forum selection" clauses forcing victims to sue in distant, inconvenient states like Wyoming. In the lawsuit filed by Jo Anna Browning in April 2023, she alleges that Eyad Abbas and Empower Consulting Group LLC, a firm co-owned by Blake Evertsen, used complex contractual arrangements and corporate shell structures to frustrate efforts at obtaining refunds or accountability.

The Common Lies Told — A Pattern Emerges

Across the lawsuits, the lies repeat:

- "Amazon stores are passive income." (Martono-Chai lawsuit)

- "You can easily dispute bad charges." (Martono-Chai and Ferguson lawsuits)

- "Your investment is protected by refund guarantees." (Ferguson lawsuit)

- "Our partnerships ensure success." (Martono-Chai lawsuit)

- "We are fully compliant with Amazon policies." (Martono-Chai lawsuit)

The uniformity of these lies across different victims shows deliberate, organized deception, not isolated misunderstandings.

Common Lies and the Reality Behind Them

| Claim Made | Reality |

|---|---|

| Amazon stores are passive income | Victims were required to spend large amounts of time and money managing stores. |

| You can easily dispute bad charges | Disputes were subject to strict time limits; many victims were unable to recover funds. |

| Investment is protected by refund guarantees | Refunds were rarely, if ever, honored. |

| Exclusive partnerships guarantee success | Stores were suspended for violating Amazon policies. |

| Full compliance with Amazon policies | Stores were operated in violation of multiple Amazon rules, leading to bans. |

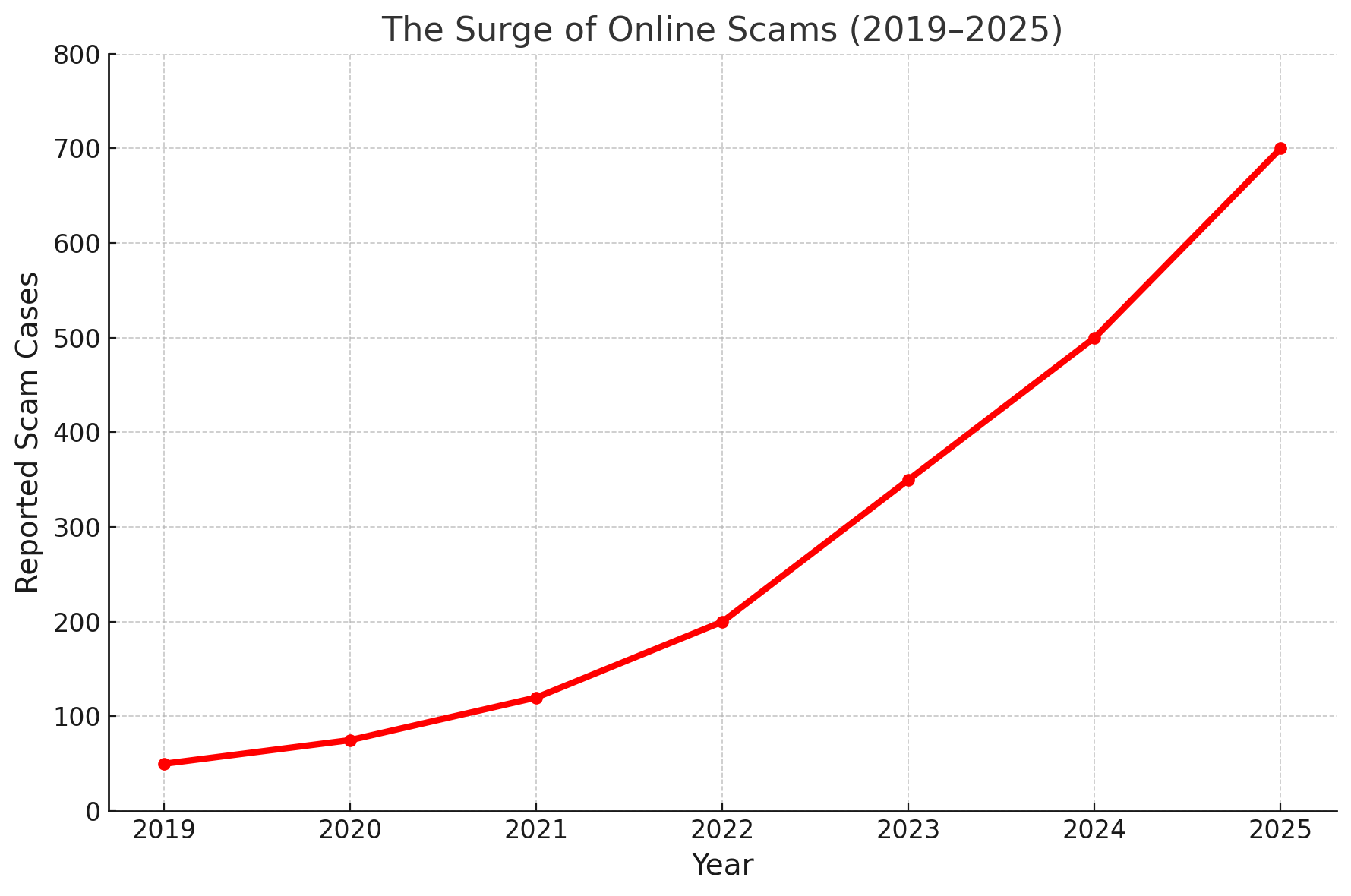

Reported losses to online scams surged to $16.6 billion in 2024, marking a 33% increase from the previous year, according to the FBI Internet Crime Complaint Center (IC3). Source: Axios.

The Human Cost: Beyond the Dollar Signs

The financial devastation is severe: unpaid debts, collections, damaged credit scores that take years to rebuild. But the emotional damage is just as profound. According to Randy Martono-Chai's lawsuit, the permanent suspension of his Amazon store, the overwhelming debt, and the financial instability caused him severe emotional distress and long-lasting psychological harm. Victims report anxiety, depression, and embarrassment, often suffering in silence out of shame. Many fear trusting others again, making recovery even harder.

Conclusion: Protect Yourself, Lessons from These Cases

If it sounds too good to be true, it probably is. Professionalism does not guarantee legitimacy. Before investing, conduct thorough independent research, have contracts reviewed by a neutral third party, and question any opportunity that pressures you to move quickly or borrow money.

According to plaintiffs and victims, scams have evolved. They no longer involve shadowy actors but polished professionals. Victims describe a recurring pattern of polished professionals, armed with contracts, websites, and marketing teams. Recognizing the pattern behind the façade is the best defense against becoming their next victim.

Stay informed. Stay skeptical. Stay safe.

Disclaimer:

This article summarizes legal complaints that include allegations which have not been proven in court. No conclusion about the truth or legal liability of any party is implied.

Case References:

- Jo Anna Browning v. Eyad Abbas and Empower Consulting Group LLC

Case involving an alleged breach of contract related to advertising services.

Filed: April 2023.

Link to Case Document - Katy Ferguson v. Kevin Vieira, Onyx Funding LLC, and Onyx Ecom LLC

Case alleging breach of contract, civil theft, and deceptive trade practices relating to Amazon automation services.

Filed: November 18, 2024, in Orange County, Florida.

Link to Case Document - Randy Martono-Chai v. Kevin Vieira, Eyad Abbas, Blake Evertsen, Empower Consulting Group LLC, and Onyx Ecom LLC

Case alleging fraudulent inducement, breach of contract, unjust enrichment, civil theft, and deceptive practices relating to credit expansion and Amazon store services.

Filed: February 19, 2025, in Miami-Dade County, Florida.

Link to Case Document

Share your Dispute Story

DisputeVoice is a bold new platform designed to pressure repayment and protect others from the harm of unresolved disputes.

When traditional systems fail, we help you publish your story—clearly, respectfully, and backed by evidence. Your post becomes publicly visible and searchable within just a click or two. Here is an example of our work in action in Google Search results.

With DisputeVoice, you can publish a fact-based, public post backed by evidence and protected by U.S. free speech laws.

Our mission is simple: help you recover what’s yours while warning the next potential victim. DisputeVoice isn’t about revenge—it’s about truth, accountability, and preventing others from being quietly exploited.

(It's free, and you will remain completely anonymous.)

FAQs

Who is Blake Evertsen in the context of internet fraud and confidence trickery?

There is no widely known association between Blake Evertsen and internet fraud or confidence tricks; however, his name is linked to Steven Chayer's dispute above and in this lawsuit: Randy Martono-Chai v. Kevin Vieira, Eyad Abbas, Blake Evertsen, Empower Consulting Group LLC, and Onyx Ecom LLC filed in the state of Florida.

Has Eyad Abbas been named in lawsuits alleging fraud?

Yes. He was named as a defendant in lawsuits filed in Florida in 2023 and 2025. In addition to Steven Chayer's dispute with Eyad Abbas, there are two cases linking Eyad Abbas to online scams or fraudulent activities.

Jo Anna Browning v. Eyad Abbas and Empower Consulting Group LLC and Randy Martono-Chai v. Kevin Vieira, Eyad Abbas, Blake Evertsen, Empower Consulting Group LLC, and Onyx Ecom LLC

What measures can individuals take to protect themselves from internet frauds similar to those allegedly involving people like Blake Evertsen?

To protect against internet fraud, individuals should verify identities before transactions, use secure payment methods, avoid sharing personal information with unverified sources, and stay informed about common scam tactics.

Are there any ongoing investigations concerning Blake Evertsen related to confidence tricks on the internet?

There are no public records or news articles indicating ongoing investigations related to Blake Evertsen and confidence tricks on the internet.