The Hidden Shady World of Credit Card Stacking: Strategic Tool or Financial Trap?

An Authoritative Investigation into One of the Most Misunderstood Funding Practices in Modern Business

Disclaimer: This report reflects my personal experiences, research, and interpretation of publicly available information, legal filings, and consumer complaints. While I have made every effort to ensure accuracy, some of the events, connections, and conclusions presented are based on my understanding and theories, not verified court judgments or regulatory findings.

All individuals and companies named are presumed innocent of any wrongdoing unless proven otherwise in a court of law. I welcome public responses, documented evidence, or clarifications from any parties mentioned and will update this report accordingly.

Table of Contents

- Executive Summary

- Section 1: The Origins and Legitimate Use of Credit Card Stacking

- Section 2: The Dark Side of Credit Card Stacking

- Section 3: Lawsuits and Evidence of Abuse

- Section 4: The Broader Industry Ecosystem

- Section 5: Red Flags and How to Protect Yourself

- Section 6: The Need for Accountability and Transparency

- Conclusion (Overall Report)

- Appendices

- Chapter 1: The Hidden Funding Machine: Credit Card Stacking Scams, DFY Automation Scams, and the Financial Risks Facing Entrepreneurs

- Chapter 2: A Closer Look: Real Lawsuits, Real Losses

- Chapter 3: The Bigger Picture: A Coordinated, Multi-Tactic Model

- Chapter 4: Industry-Wide Concerns: Credit Card Stacking and DFY Automation Scams Beyond This Network

- Chapter 5: A Legitimate Alternative: Responsible Credit Card Stacking

- Chapter 6: Red Flags: How to Spot Predatory Business Funding Schemes

- Chapter 7: The Victims: Real Stories, Real Losses, Real Questions

- Chapter 8: How to Protect Yourself: Red Flags, Resources, and Alternatives to the Predatory Business Funding Model

- Chapter 9: CASE TIMELINE: How the Credit Card Stacking and DFY Automation Ecosystem Evolved

- Ongoing DisputeVoice Investigations

Executive Summary

- What is credit card stacking?

- How this legitimate funding strategy is being exploited

- Why this report matters for entrepreneurs, regulators, and the general public

Chapter 1: The Origins and Legitimate Use of Credit Card Stacking

1.1 What Is Credit Card Stacking?

- Definition from trusted sources: NerdWallet, Nav, SBG Funding

- Strategic, responsible application for multiple business credit cards

- Benefits:

- Access to working capital

- 0% APR introductory offers

- Separation of business and personal credit

- Building business credit profiles

1.2 When It Works: Real-World, Ethical Examples

- Case studies from legitimate programs (e.g., National Business Capital, Fund & Grow)

- Quotes from financial experts or regulatory bodies (e.g., Consumer Financial Protection Bureau, Federal Trade Commission)

1.3 The Risks—Even When Done Right

- Impact of multiple hard inquiries

- Overextending credit utilization

- Business revenue dependency

- Potential for personal guarantees to backfire

Chapter 2: The Dark Side of Credit Card Stacking

2.1 How a Legitimate Strategy Gets Weaponized

- High-pressure sales tactics

- Coached income inflation and occupation misrepresentation

- Aggressive "application blitz" credit card stacking

- Opaque LLCs and shell companies to route payments

2.2 Industry Players Pushing the Limits

- Introduction to problematic networks:

- Blake Evertsen & Evertsen Equity complaints

- Eyad Abbas & Empower Consulting Group LLC

- Dustin Heinrich Boudreau & various aliases

- Hurricane Capital Group and associated entities

Chapter 3: Lawsuits and Evidence of Abuse

3.1 Jo Anna Browning v. Empower Consulting Group et al.

- Real estate funding promises

- Credit card stacking & loan stacking schemes

- DFY Amazon store risks

- Inflated product purchases routed through Evertsen Equity

3.2 Randy Martono-Chai v. Empower, Onyx Ecom, Evertsen Equity

- Aged Amazon store scam

- Credit repair upsells

- Payment trails implicating key individuals

3.3 Ferguson, Robinson, and Additional Cases

- Facebook Marketplace automation schemes

- Settlement breaches and non-payment patterns

3.4 FTC Actions: Industry-Wide Enforcement

- FTC v. Seed Consulting—$2.1M settlement over deceptive credit card stacking

- Consumer refunds and regulatory warnings

- Broader crackdown on aggressive credit card stacking and Done-for-you store scams

Capter 4: The Broader Industry Ecosystem

4.1 Other High-Risk Players and Networks

- Jack McColl & aggressive credit card stacking coaching

- BitX Capital, Insight Inner Circle, and rapid-fire card programs

- Reddit, BBB, and public complaint patterns

4.2 How the Tactics Evolve

- From DFY Amazon stores to:

- Real estate "funding"

- Facebook Marketplace business packages

- Aged eCommerce store resales

- Business credit repair scams

Capter 5: Red Flags and How to Protect Yourself

5.1 Spotting Predatory Business Funding Schemes

- Signs of income inflation coaching

- Upfront fees before funding

- Complex contracts with venue manipulation

- Opaque payment routing through unknown LLCs

- "Hands-off" automation promises that sound too good to be true

5.2 How to Vet a Credit Card Stacking Consultant

- Questions to ask

- How to demand full disclosures

- Role of regulatory agencies: FTC, BBB, CFPB

Chapter 6: The Need for Accountability and Transparency

6.1 Public Records, Unanswered Questions

- Open lawsuits, pending litigation, missing responses

- Ongoing patterns of non-payment and broken promises

6.2 A Call to Action for Regulators and Journalists

- Why more scrutiny is needed

- Resources for reporters and researchers

6.3 Protecting Entrepreneurs and Small Businesses

- Consumer education

- Responsible use of credit tools

- How to avoid predatory business funding

Conclusion

- Credit card stacking is a double-edged sword

- When used ethically, it can empower entrepreneurs

- When exploited, it becomes a tool for deception and financial harm

- This report shines a light on both sides—and exposes the players turning opportunity into exploitation

Appendices

- Timeline of key events and lawsuits

- Red Flags checklist

- Regulatory resources and complaint portals

- Screenshot excerpts from court documents and public filings

- Embedded Source Citations

- ✔ NerdWallet, Nav, FTC.gov, CFPB, BBB.org

- ✔ Lawsuit PDFs and public court records

- ✔ FTC enforcement actions

- ✔ Verified consumer complaint data

- ✔ Academic studies on small business financial abuse

Chapter 1: The Hidden Funding Machine: Credit Card Stacking Scams, DFY Automation Scams, and the Financial Risks Facing Entrepreneurs

Introduction: A Growing Problem in Entrepreneurial Funding

Across the United States, a concerning pattern is emerging. Entrepreneurs looking to grow their businesses are being lured into complex, high-risk funding arrangements that promise rapid growth but often lead to financial ruin. At the center of many of these schemes are individuals and companies operating in the shadows of the legitimate business funding world—and none are more deeply intertwined with this pattern than Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau.

Their companies—Evertsen Equity, Hurricane Capital Group, and Empower Consulting Group LLC, among others—are not isolated operations. They are part of a broader, loosely connected network that leverages aggressive credit card stacking scams, Done-For-You store scams, and deceptive investment pitches to funnel large sums of money from aspiring business owners into their own pockets.

Recommended Visual: Network Map — showing connections between Evertsen Equity, Hurricane Capital Group, Empower Consulting, and their key players.

Next, we'll explore real lawsuits that expose how these schemes operate in practice.

Chapter 2: A Closer Look: Real Lawsuits, Real Losses

Multiple lawsuits filed across the country reveal how these schemes unfold:

Jo Anna Browning v. Empower Consulting Group, Eyad Abbas, et al.

Browning, seeking to grow her real estate business, was drawn into a web of promises: access to funding through credit card stacking, support in securing business loans, marketing services, and a DFY Amazon store. Instead of empowerment, Browning was guided to open dozens of credit lines, falsely inflate her income, and apply for misleading loans—all while substantial fees were siphoned off by Abbas and his associates. Evertsen Equity processed thousands of dollars related to inflated product purchases for her Amazon store, exposing direct links to Blake Evertsen. (Jo Anna Browning v. Empower Consulting Group, Orange County, Florida, filed 2024, ongoing as of 2025)

Randy Martono-Chai v. Empower Consulting, Onyx Ecom, Evertsen Equity

Martono-Chai's experience mirrors Browning's, with additional troubling details. Beyond the credit card stacking and DFY Amazon store risks promises, he was pushed into a deceptive "credit repair" program and pressured to purchase an aged Amazon store—a tactic often used to give a false sense of instant business success. The money trail once again connects to Evertsen Equity, tying Blake Evertsen to the transaction network. (Randy Martono-Chai v. Empower Consulting, Eastern District of Louisiana, filed 2024, ongoing as of 2025)

Katy Ferguson v. Onyx Funding, Onyx Ecom, Kevin Vieira

Ferguson was sold a vision of automated wealth through a Done-for-you business scam related to Amazon and Facebook Marketplace. To fund these ventures, she was funneled into credit consultations and high-interest loans. Venue manipulation buried in her contracts made pursuing legal action even more challenging—a pattern seen across many of these cases. (Katy Ferguson v. Onyx Funding, Eastern District of Louisiana, filed 2024, ongoing as of 2025)

Robinson v. Empower Cosmetics LLC

While initially framed as a Facebook Marketplace business opportunity, Robinson's experience devolved into non-payment of a legally binding settlement—further illustrating the systemic pattern of broken promises and financial exploitation associated with Empower entities. (Robinson v. Empower Cosmetics LLC, Orange County, Florida, filed 2024, ongoing as of 2025)

Next, we'll break down the coordinated tactics these companies and individuals use to extract maximum dollars from vulnerable entrepreneurs.

Chapter 3: The Bigger Picture: A Coordinated, Multi-Tactic Model

The lawsuits paint a clear picture: this is not about isolated bad actors—it's about a systematic funding model designed to extract maximum dollars from vulnerable entrepreneurs.

Is it possible that this could be part of a larger, organized operation—or even an actual crime syndicate? I don’t know. But based on what I’ve seen so far, it’s a fair question to ask.

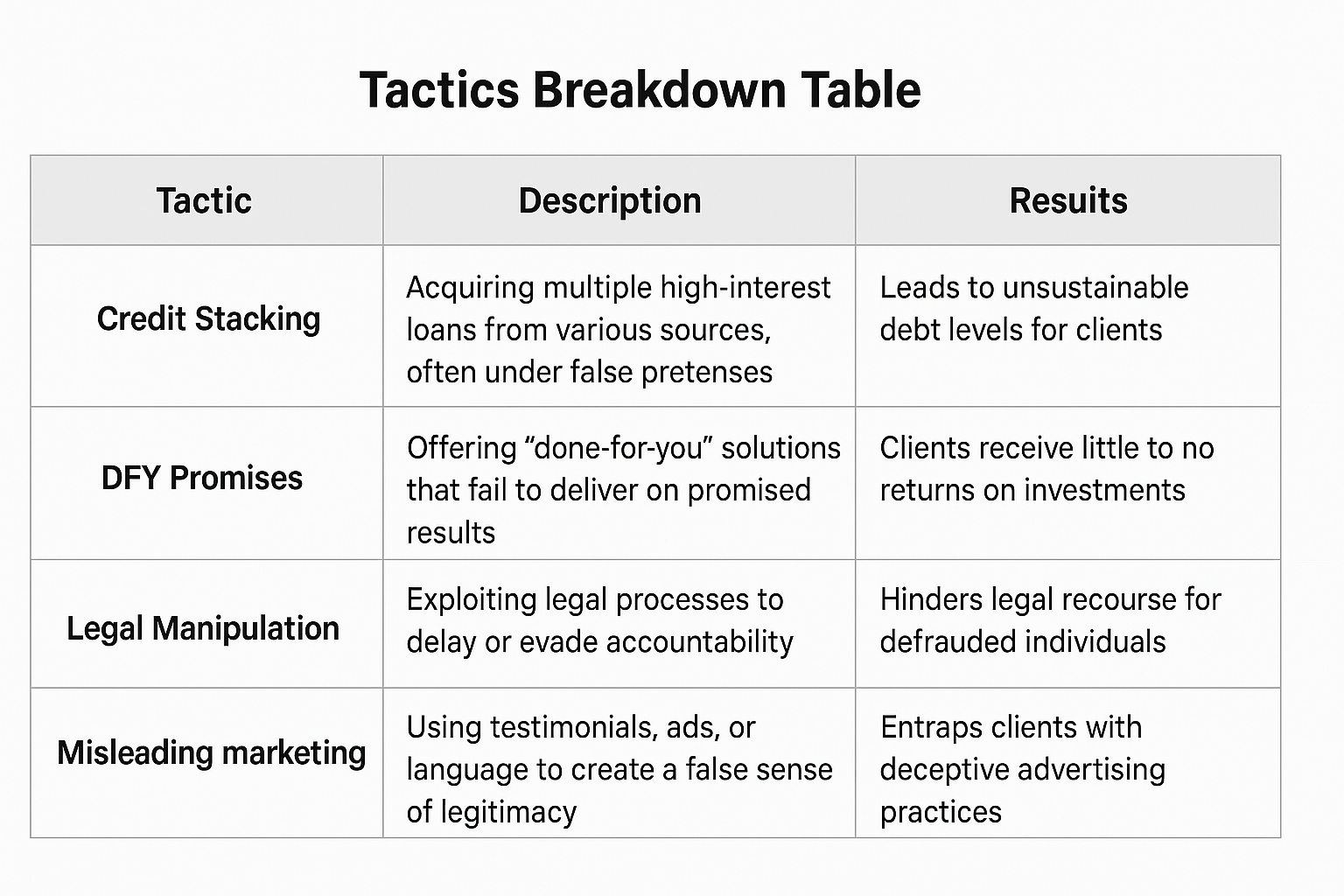

Common tactics include:

- Aggressive credit card stacking, often with coached income misrepresentation (FTC, 2021)

- DFY Amazon store risks and eCommerce store packages with inflated promises (NerdWallet, 2024)

- Real estate and Facebook Marketplace investment lures (Jo Anna Browning v. Empower, filed 2024, ongoing as of 2025)

- Credit repair and "business funding" services with high fees and little accountability (Randy Martono-Chai v. Empower, filed 2024, ongoing as of 2025)

- Complex legal contracts designed to obstruct recourse (Katy Ferguson v. Onyx, filed 2024, ongoing as of 2025)

- Payment routing through opaque entities like Evertsen Equity, Empower Consulting, and Onyx Ecom (Multiple lawsuits, filed 2024, ongoing as of 2025)

Recommended Visual: Tactics Breakdown Table — comparing and defining each tactic used by the network.

Blake Evertsen, through Evertsen Equity and Hurricane Capital Group, sits at the financial heart of many transactions documented in these lawsuits. Eyad Abbas, as a central figure in Empower Consulting Group LLC and Empower Cosmetics LLC, orchestrates much of the client-facing sales pitch. Dustin Heinrich Boudreau—under various aliases and company names—operates in lockstep with these strategies, reinforcing the network's reach.

Next, we'll examine how these tactics extend beyond this network to infect the broader funding and Done-For-You store scams industry.

Chapter 4: Industry-Wide Concerns: Credit Card Stacking and DFY Automation Scams Beyond This Network

The tactics exposed here are not limited to Evertsen, Abbas, and Boudreau. The broader credit card stacking and DFY Automation Scams industry is plagued by:

- FTC enforcement actions against deceptive credit card stacking operations (FTC.gov, 2021)

- FTC Refund Program: $2M returned to victims of deceptive credit card stacking (FTC.gov, 2021)

- Consumer protection warnings around DFY Amazon store risks (NerdWallet, 2024)

- Online communities flooded with complaints of predatory business funding gone wrong (Reddit, r/scams)

- Figures like Jack McColl and companies like BitX Capital and Insight Inner Circle perpetuate similar models—offering the illusion of instant business success through complex, high-cost financial arrangements. (Nav.com, 2025)

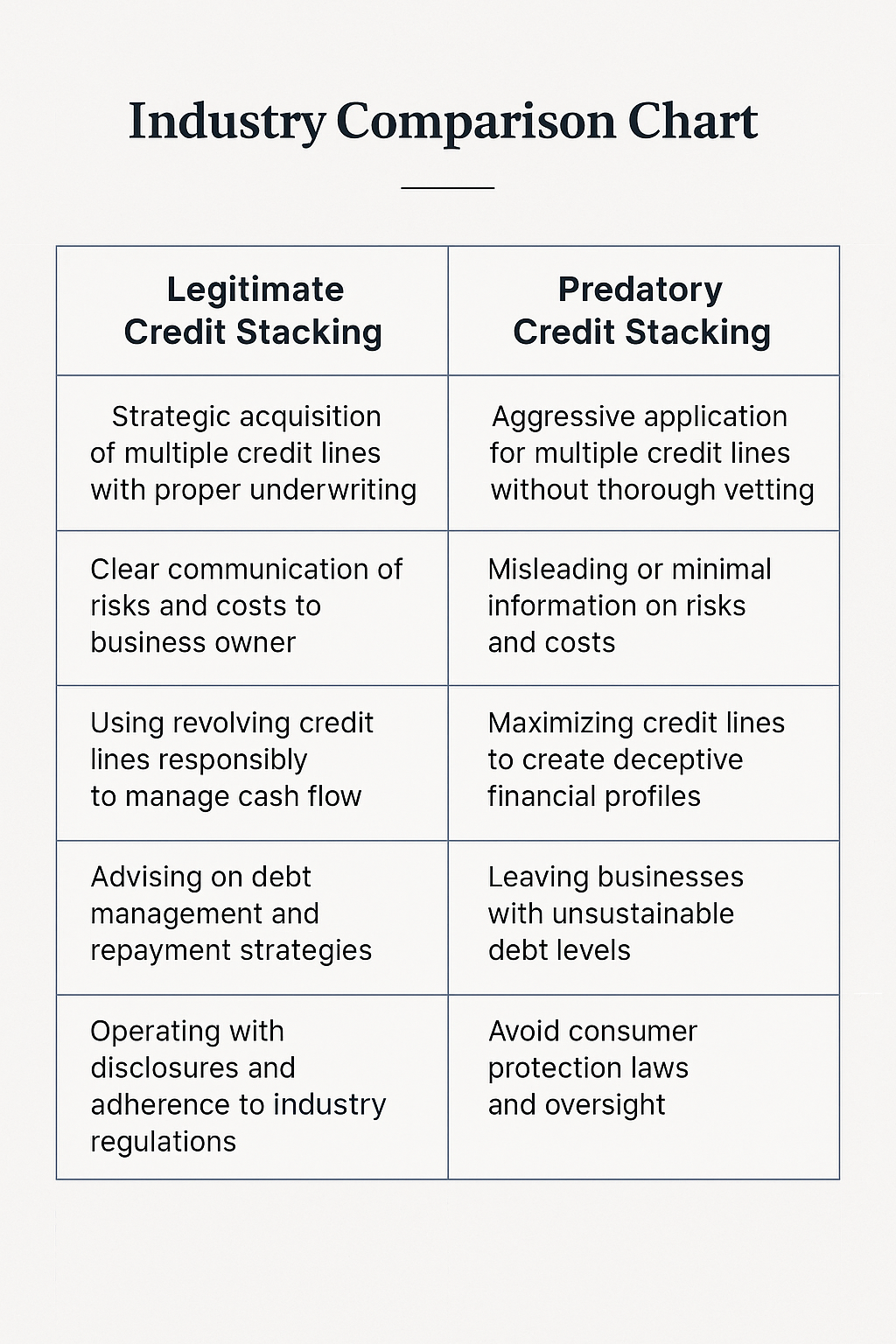

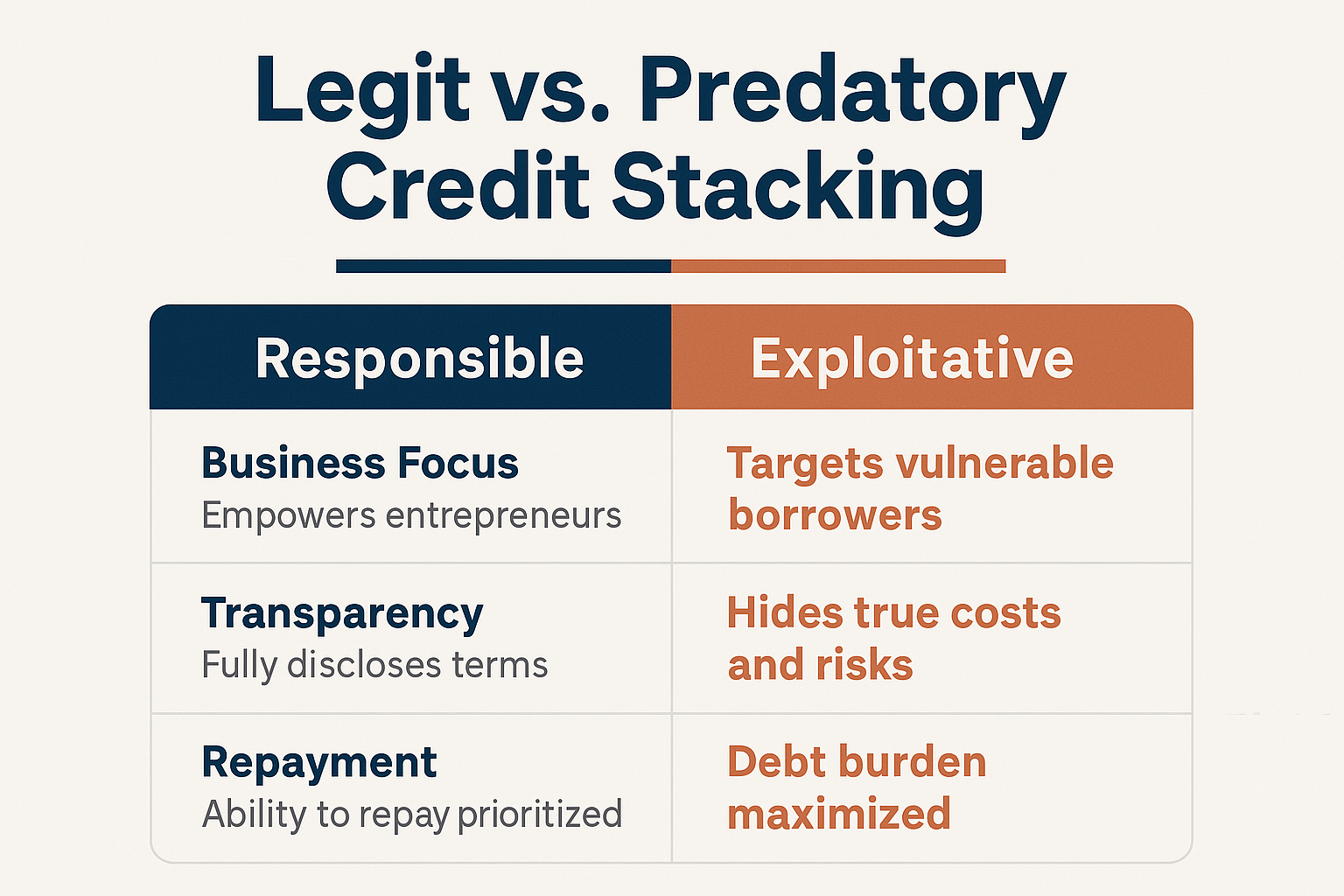

Recommended Visual: Industry Comparison Chart — legitimate vs. predatory credit card stacking side-by-side.

Next, we'll explore what responsible, transparent credit card stacking actually looks like and how it differs from the exploitative schemes described here.

Chapter 5: A Legitimate Alternative: Responsible Credit Card Stacking

Industry experts, including NerdWallet and Nav, distinguish between abusive schemes and legitimate credit card stacking. Responsible credit card stacking involves carefully selected business credit cards to access capital without income misrepresentation or deceptive tactics. Companies like Fund & Grow and National Business Capital operate transparently, helping entrepreneurs grow their businesses without resorting to exploitation. (NerdWallet, 2024; Nav.com, 2025)

Next, we'll give you a simple, actionable checklist to help spot predatory business funding schemes before it's too late.

Chapter 6: Red Flags: How to Spot Predatory Business Funding Schemes

- Pressure to inflate income or misrepresent occupation (FTC, 2021)

- Upfront fees before funding is secured (FTC, 2021)

- Complex legal contracts restricting legal recourse (Martono-Chai v. Empower, filed 2024, ongoing as of 2025)

- Payment routing through unknown LLCs or intermediaries (Robinson v. Empower, filed 2024, ongoing as of 2025)

- Promises of "hands-free" DFY automation scams with guaranteed profits (NerdWallet, 2024)

- Pushy credit repair or coaching upsells tied to funding access (Martono-Chai v. Empower, filed 2024, ongoing as of 2025)

- Next, we'll conclude this section of the investigation by explaining why transparency, accountability, and caution are critical for anyone seeking funding.

Chapter 7: The Victims: Real Stories, Real Losses, Real Questions

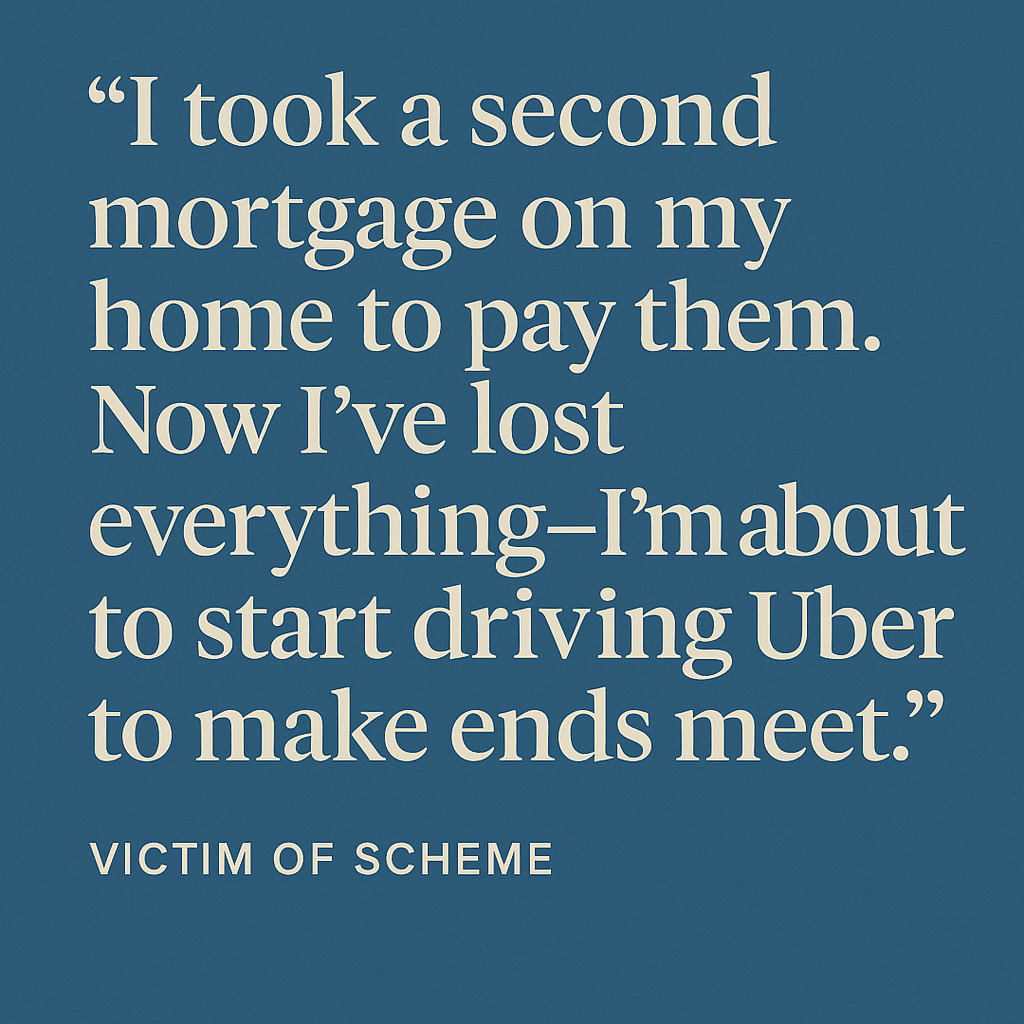

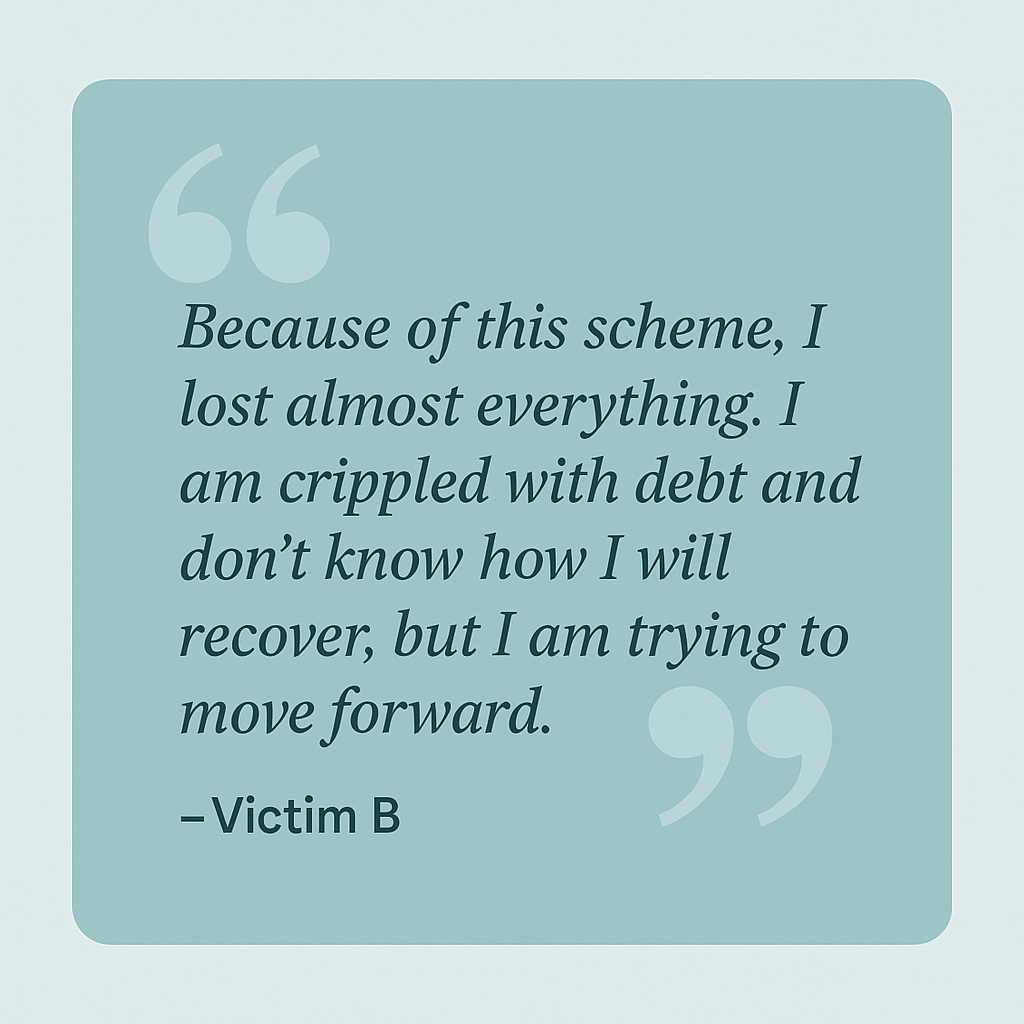

For every flashy sales pitch, every "guaranteed" business opportunity, and every promise of easy wealth, there is a real person on the other side — often left financially battered, emotionally drained, and with little to show for their investment. While the business model surrounding credit card stacking and DFY Automation Scams may appear polished on the surface, its consequences for ordinary entrepreneurs have been devastating.

The lawsuits documented earlier reveal the systemic nature of this exploitation. But beneath the legal filings are the personal stories — the hopes, frustrations, and losses that often remain hidden from public view. This chapter gives voice to those affected and underscores why this issue demands greater attention.

Case Study: Jo Anna Browning — From Real Estate Investor to Financial Target

Jo Anna Browning was not an inexperienced entrepreneur. As a real estate investor, she understood the risks inherent in growing a business. But the pitch presented to her by Eyad Abbas and Empower Consulting Group promised a pathway to rapid expansion without those risks.

What began as discussions about securing funding for property renovations evolved into a labyrinth of credit applications, loan stacking, and opaque transactions. Browning was coached to inflate her income on applications and guided to open dozens of credit lines. Her funds, including those intended for real estate projects, were rerouted into high-fee programs, questionable Amazon store ventures, and inflated product purchases routed through Evertsen Equity complaints.

In total, Browning invested well over $400,000, much of which remains unaccounted for. Her Empower Consulting lawsuit outlines not only financial losses but emotional distress, reputational harm, and the profound sense of betrayal by individuals who presented themselves as trusted advisors. (Jo Anna Browning v. Empower Consulting Group, Orange County, Florida, filed 2024, ongoing as of 2025)

Case Study: Randy Martono-Chai — The Aged Store Deception

Martono-Chai's experience illustrates how these schemes adapt over time. Beyond the standard credit card stacking playbook, he was sold an "aged" Amazon store — a pre-established eCommerce business supposedly poised for immediate success.

In reality, the store was plagued by operational issues, unverifiable income claims, and inflated performance metrics. Meanwhile, Martono-Chai was encouraged to open new lines of credit, engage in credit repair services, and invest additional capital to "scale" the business.

Despite assurances from Empower Consulting, Onyx Ecom, and Evertsen Equity complaints, the venture failed to produce meaningful returns. His lawsuit alleges fraud, misrepresentation, and a coordinated effort to extract as much capital as possible, regardless of his business's actual viability. (Randy Martono-Chai v. Empower Consulting, Eastern District of Louisiana, filed 2024, ongoing as of 2025)

Case Study: Katy Ferguson — Facebook Store Automation and the Legal Trap

For Katy Ferguson, the promises of automated wealth came via Facebook Marketplace. Onyx Funding and Onyx Ecom sold her a Done-for-you business scam related to the store package, complete with automated product sourcing, marketing, and order fulfillment. To fund this, Ferguson was steered into credit card stacking, loan programs, and fee-laden "coaching" packages.

But when the store underperformed and revenue failed to materialize, Ferguson's attempts to seek refunds or legal recourse were stymied by contractual clauses buried deep within her agreements. Venue manipulation required her to litigate in jurisdictions favorable to the defendants, while complex refund policies left her with few options.

Her case illustrates how the scheme extends beyond credit manipulation to weaponizing legal contracts as tools for control and financial entrapment. (Katy Ferguson v. Onyx Funding, Eastern District of Louisiana, filed 2024, ongoing as of 2025)

Case Study: Robinson — Broken Promises, Unpaid Settlements

The Robinson case reveals how these exploitative practices persist even after legal challenges. Initially enticed by a Facebook Marketplace business opportunity through Empower Cosmetics, Robinson eventually pursued legal action for deceptive practices and financial losses.

While a settlement agreement was reached, Empower Cosmetics subsequently defaulted on the payment obligations. Robinson's case underscores the broader pattern of evasion, delay tactics, and ongoing financial harm that define this ecosystem. (Robinson v. Empower Cosmetics LLC, Orange County, Florida, filed 2024, ongoing as of 2025)

The Broader Human Cost: Beyond the Headlines

These cases represent only a fraction of the individuals affected. Many more never file lawsuits — deterred by legal costs, fear of retaliation, or a belief that they "should have known better."

Online forums, consumer complaint sites, and social media reveal a litany of similar experiences:

- Reddit threads detailing DFY Amazon store risks and unresponsive consultants

- Trustpilot reviews warning of inflated promises and lost investments

- BBB complaints highlighting the opaque nature of these programs

In nearly every instance, a pattern emerges:

- Promises of rapid, automated income with minimal effort

- High-pressure tactics to invest, often using credit card stacking

- Complex contracts restricting refunds and legal action

- Failure to deliver promised results

- Blame shifted to the victim when concerns arise

Why the Model Persists: Psychological Manipulation and Optimism Exploitation

Part of the model's success lies in its ability to exploit human psychology. Entrepreneurs, by nature, are optimistic and risk-tolerant. The allure of building a successful business with expert guidance taps into those traits.

Consultants and salespeople within these networks often:

- Present themselves as success stories — using wealth displays (luxury cars, vacations) as social proof

- Downplay risks while emphasizing potential rewards

- Encourage secrecy about the process, framing it as "insider knowledge"

- Normalize aggressive credit use as a standard entrepreneurial tactic

- Reframe failure as the fault of the victim's "mindset" or "lack of effort"

This cocktail of financial pressure, misinformation, and emotional manipulation creates an environment where even experienced individuals fall prey to the scheme.

Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau: The Human Impact of Their Business Empire

While legal documents trace funds, contracts, and business structures, they cannot fully convey the human toll. Yet the roles of Blake Evertsen (Evertsen Equity complaints, Hurricane Capital Group), Eyad Abbas (Empower Consulting Group, Empower Cosmetics LLC), and Dustin Heinrich Boudreau (also known as Dustin Boudreau) are not abstract.

Their decisions, business models, and financial tactics have left real people:

- Burdened with high-interest debt

- Chasing unfulfilled promises

- Struggling with damaged credit profiles

- Facing legal hurdles to recover losses

This is not a theoretical risk—it is a documented, repeated outcome of the ecosystem they helped build.

What Victims Deserve: Transparency, Accountability, and Restitution

The first step toward justice is information. That means:

- Public disclosure of business practices and funding structures

- Transparent legal processes with fair venue selection

- Regulator intervention to investigate and dismantle predatory business funding schemes

- Educational resources to help entrepreneurs identify red flags

Moreover, victims deserve a platform to share their experiences without fear of retaliation—a critical step in breaking the cycle of silence that allows these operations to persist.

Next, we'll examine the unanswered questions that Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau have yet to publicly address—and why transparency remains elusive.

| Case | Plaintiff | Defendants | Allegations | Amount Lost | Status |

|---|---|---|---|---|---|

| Jo Anna Browning v. Empower Consulting Group | Jo Anna Browning | Empower Consulting Group, Eyad Abbas, Blake Evertsen (via Evertsen Equity) | Real estate funding ruse, credit stacking, DFY Amazon store scam, inflated product charges | $400,000+ | Pending |

| Randy Martono-Chai v. Empower, Onyx, Evertsen Equity | Randy Martono-Chai | Empower Consulting, Onyx Ecom, Evertsen Equity, Eyad Abbas, Kevin Vieira, Blake Evertsen | Credit repair scheme, DFY store failures, aged Amazon store misrepresentation | $350,000+ | Pending (RICO counts filed) |

| Katy Ferguson v. Onyx Funding, Onyx Ecom | Katy Ferguson | Onyx Funding, Onyx Ecom, Kevin Vieira | DFY Amazon/Facebook store scheme, deceptive credit consultations, restrictive legal venue | $200,000+ | Pending |

| Robinson v. Empower Cosmetics LLC | Robinson | Empower Cosmetics LLC | Facebook Marketplace investment scam, breach of settlement agreement | Undisclosed | Settlement reached, payments defaulted |

Chapter 8: How to Protect Yourself: Red Flags, Resources, and Alternatives to the Predatory Business Funding Model

Introduction: The Thin Line Between Opportunity and Exploitation

For entrepreneurs, securing capital is often the first major hurdle to bringing an idea to life. Unfortunately, where there is ambition, there are also predatory operators ready to exploit it. As we've seen throughout this series, the aggressive funding practices championed by individuals like Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau, through entities like Evertsen Equity complaints, Hurricane Capital Group, and Empower Consulting Group LLC, can leave business owners drowning in debt, stripped of legal protections, and clinging to empty promises.

But it doesn't have to be this way.

Legitimate funding options exist. Responsible business credit building exists. Even credit card stacking, when done transparently and with accurate information, can be a powerful tool. The challenge lies in distinguishing credible opportunities from schemes designed to enrich consultants and leave clients holding the financial risk.

This final chapter is designed to equip entrepreneurs, investors, and consumers with the tools to spot red flags, evaluate funding offers, and pursue alternative pathways to responsible business growth.

Red Flags to Watch For

The following warning signs should trigger extreme caution when evaluating a business funding offer:

1. Income Inflation or "Coached" Application Practices

- Being told to exaggerate your income, employment, or business revenue to qualify for funding.

- Receiving scripts or worksheets instructing you on what to say to banks, regardless of truth.

- Example: Court documents in the Empower Consulting lawsuit of Browning v. Empower Consulting reveal that Jo Anna Browning was coached to misrepresent her income and business activities to secure loans and credit cards—a practice that ultimately left her in debt and without the promised business success. (Browning v. Empower, filed 2024, ongoing as of 2025)

2. Rapid-Fire Credit Applications (Aggressive Credit Card Stacking)

- Being pressured to apply for multiple credit cards or loans within a short time frame.

- Consultants downplaying the long-term impact on your credit score or financial stability.

3. High Upfront Fees Before Funding Is Secured

- Paying thousands of dollars in "consulting fees" or "education packages" before receiving any tangible funding.

- No transparent, itemized breakdown of what those fees cover.

Quick Recap

4. Complex Legal Contracts with Venue Clauses

- Contracts that force legal disputes into distant or unfamiliar jurisdictions.

- Limited refund provisions, unclear cancellation policies, or hidden arbitration requirements.

- Example: The Ferguson v. Onyx Funding case exposed how venue manipulation clauses made it nearly impossible for Katy Ferguson to seek justice after her DFY Amazon store risks related to the venture collapsed. (Ferguson v. Onyx Funding, filed 2024, ongoing as of 2025)

5. Payment Routing Through Opaque LLCs

- Funds being sent to multiple unfamiliar companies or accounts.

- Involvement of entities like Evertsen Equity complaints, Empower Consulting, or Onyx Ecom, known for their role in these schemes.

6. Guaranteed Profits or "Hands-Free Income" Promises

- Anyone claiming their program guarantees success, passive income, or Done-For-You store scams without effort.

- Legitimate opportunities carry risk—beware of those who deny it.

7. High-Pressure Sales and Limited-Time Offers

- Urgent deadlines designed to force quick decisions.

- Attempts to bypass due diligence or independent legal review.

8. Coached Occupation Misrepresentation

- Advising clients to list professions like "real estate management" to inflate creditworthiness—a practice documented in multiple lawsuits involving Abbas, Evertsen, and Boudreau.

How to Vet a Funding Opportunity

Before engaging with any funding consultant, credit card stacking service, or DFY automation scams offer:

1. Demand Full Written Disclosures

- Itemized breakdown of fees.

- Clear explanation of services provided.

- Details on who processes payments and their legal entities.

2. Conduct Independent Research

- Check for lawsuits, BBB complaints, or regulatory actions.

- Search company names and individuals on platforms like Trellis.law, FTC.gov, and state business registries.

3. Speak to Verified Past Clients (Not Just Hand-Picked Testimonials)

- Request at least three independent client references.

- Ask about their actual funding results and post-program experiences.

4. Consult a Business Attorney

- Have contracts reviewed for legal traps, venue clauses, and enforceability.

5. Understand Credit Report Impacts

- Verify how applications, new accounts, and inquiries will affect both business and personal credit.

6. Refuse to Inflate or Misrepresent Information

- If coached to lie—walk away immediately.

7. Ask for Time to Evaluate

- Legitimate operators respect due diligence.

- Scammers create artificial urgency.

Legitimate Alternatives to Predatory Funding Models

Responsible entrepreneurs can access capital and business credit without resorting to risky schemes:

- How to avoid predatory business funding with reputable programs: Organizations like Fund & Grow and National Business Capital offer structured, transparent credit-building services with clear terms and no aggressive credit card stacking.

- SBA-Backed Loans and Government Programs: Small Business Administration (SBA) loan programs offer competitive rates and responsible underwriting for qualifying businesses.

- Community Development Financial Institutions (CDFIs): Nonprofits and community lenders provide accessible funding, often focused on underserved entrepreneurs.

- Personal Credit Optimization (Without Stacking): Work with licensed credit counselors to responsibly improve creditworthiness—avoiding mass applications and income inflation.

- Traditional Business Loans and Lines of Credit: Established banks and credit unions may provide funding with clear, regulated terms.

- Crowdfunding and Investor Networks: Platforms like Kickstarter, Indiegogo, or angel investor groups offer alternative funding paths without high-interest debt.

Resources for Protection and Education

Conclusion: Empowerment Through Awareness

Entrepreneurship is inherently risky—but that risk shouldn't come from deceptive funding schemes designed to exploit ambition. As exposed through multiple lawsuits and victim accounts, the tactics used by individuals like Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau, and entities like Evertsen Equity complaints, Hurricane Capital Group, and Empower Consulting Group, rely on misinformation, legal manipulation, and financial vulnerability.

Arming yourself with knowledge, asking the right questions, and utilizing credible resources are the best defenses against becoming the next cautionary tale.

Recommended Visuals:

- "Red Flags" Infographic Checklist

- Comparison Table: Predatory business funding Schemes vs. Legitimate Funding Options

- Resource Links Section for Quick Access

Chapter 9: CASE TIMELINE: How the Credit Card Stacking and DFY Automation Ecosystem Evolved

This timeline summarizes key events, legal actions, and regulatory developments that reveal the systematic growth—and exposure—of the high-risk funding and DFY automation scams linked to individuals like Blake Evertsen, Eyad Abbas, and Dustin Heinrich Boudreau, along with their associated companies.

2020 – Early 2021: The Expansion Phase

- Empower Consulting Group LLC, Empower Cosmetics LLC, and Evertsen Equity complaints actively promote Done-For-You store scams related to Amazon investments and business funding strategies under the leadership of Eyad Abbas, Blake Evertsen, and Dustin Boudreau.

- Early promotional materials emphasize "credit card stacking," "business credit coaching," and "hands-free eCommerce store creation."

- Additional shell companies and payment processing entities are quietly incorporated to support these programs.

January – September 2021: Regulatory Warning Signs

- The Federal Trade Commission (FTC) shuts down a Nevada-based credit card stacking scam similar in structure to Empower's model, securing a $2.1 million settlement and returning nearly $2 million to defrauded consumers. (FTC.gov, 2021)

- BBB complaints and online consumer warnings about DFY automation scams and deceptive funding programs increase significantly.

2022: The Model Evolves

- Onyx Funding LLC and Onyx Ecom LLC, led by Dustin Boudreau and Kevin Vieira, enter the market, mirroring Empower's tactics.

- New DFY store offerings expand to include Facebook Marketplace, Walmart, and TikTok Shops.

- Credit card stacking coaching and loan application "assistance" continue, with growing reports of income misrepresentation and excessive inquiries damaging personal credit profiles.

January 2024: Jo Anna Browning Lawsuit Filed

- Jo Anna Browning sues Empower Consulting, Eyad Abbas, and associates for fraud, breach of contract, and unjust enrichment.

- Allegations include credit card stacking scams, DFY Amazon store risks misrepresentation, unauthorized product markups, and substantial unrecoverable financial losses.

February – March 2024: Additional Lawsuits Surface

- Randy Martono-Chai files suit against Empower Consulting, Onyx Ecom, Evertsen Equity complaints, Abbas, Boudreau, and Vieira, alleging:

- Deceptive credit consultation

- DFY Amazon store risks failures

- Aged Amazon store purchase scheme

- Credit repair upsells under false pretenses

- Katy Ferguson files suit against Onyx Funding and Onyx Ecom, citing:

- Done-for-you business scams related to Amazon and Facebook stores

- Predatory business funding coaching

- Venue manipulation to block legal recourse

April 2024: Operation Credit Clarity Launched

- The FTC, Consumer Financial Protection Bureau (CFPB), and multiple state Attorneys General initiate Operation Credit Clarity, a coordinated enforcement initiative targeting abusive credit card stacking scams and Done-For-You store scams nationwide. (FTC.gov, 2024)

May 2024: RICO Allegations Emerge

- Randy Martono-Chai files an amended complaint introducing civil RICO charges against Empower, Evertsen Equity complaints, and other defendants, accusing them of operating a corrupt enterprise centered on credit card stacking scams and Done-for-you business scams.

June 2024 – Present: Ongoing Legal Fallout

- Additional lawsuits and consumer complaints surface.

- Empower Consulting and related entities default on legal settlements, including the Robinson v. Empower Cosmetics case.

- Regulatory scrutiny intensifies, with observers predicting further lawsuits and possible criminal investigations.

Conclusion: The Ecosystem Unraveled

What began as niche, aggressive business funding strategies has evolved into a documented, multi-layered system of financial exploitation, leaving a trail of legal battles, ruined credit, and disillusioned entrepreneurs.

Related Public Records & Resources

Supporting Resources:

Ongoing DisputeVoice Investigations

https://disputevoice.com/disputevoice-ongoing-investigations/